Trusted by global leaders

Why leading organisations choose Mitiga Solutions

Our technology combines scientific rigour with decision intelligence to help organisations see the full picture, not just site-level fragments. Built on validated climate models and proprietary analytics, Mitiga Solutions reveals where risk accumulates, how it evolves, and what it means for performance and value.

Scientific integrity

Spin-out from Spain’s National Supercomputing Centre, backed by 20 years of peer-reviewed research and validated by leading institutions.

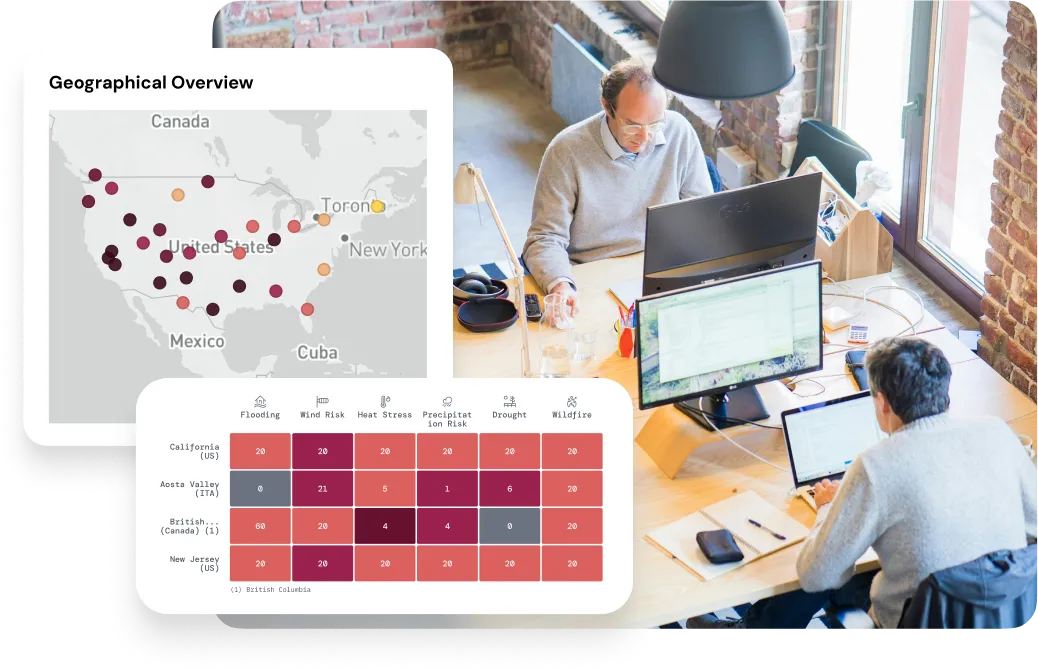

Portfolio-scale intelligence

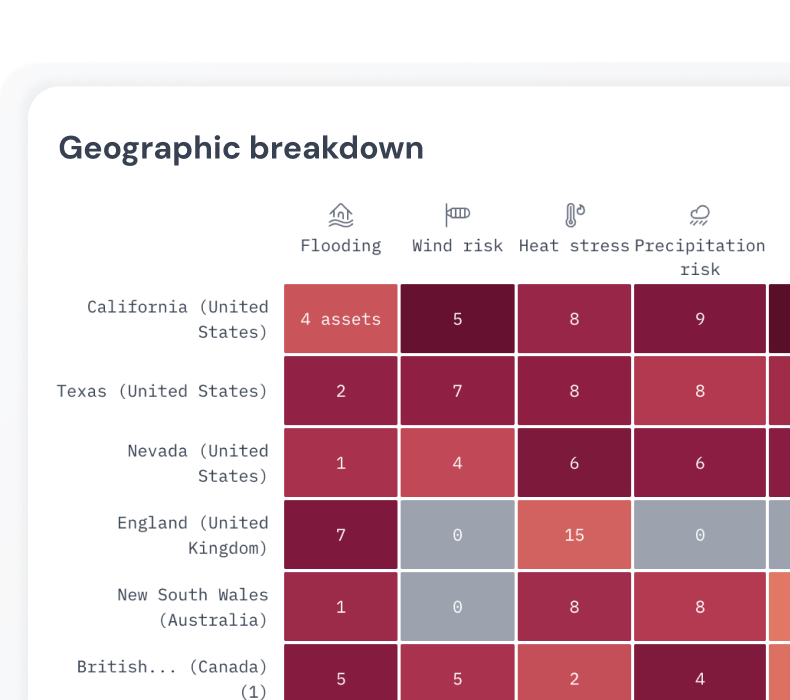

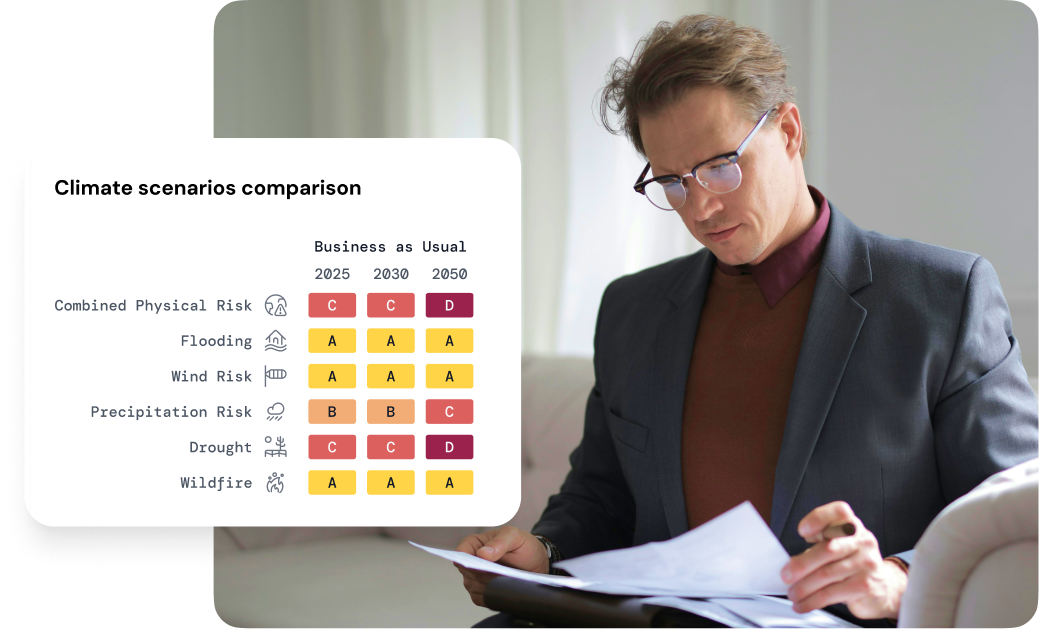

Analyse thousands of assets consistently across geographies, scenarios, and time horizons to expose systemic and correlated risks.

Decision-ready insights

Turn complex climate data into clear financial and operational signals that inform ERM, capital allocation, and disclosure.

Speed and repeatability

Replace months of manual analysis with fast, scalable workflows that can be refreshed as portfolios or conditions change.

From fragmented data to enterprise-wide foresight

Climate risk isn’t evenly distributed; it clusters, compounds, and concentrates where value is at stake. Mitiga Solutions helps you identify those concentrations, compare exposure across regions, and prioritise where action delivers the greatest return.

Embed climate foresight into every portfolio decision

Portfolio assessment connects climate science with strategic, financial, and operational decisions. Organisations use Mitiga Solutions to integrate climate foresight into the key moments where risk meets value.

Enterprise risk management (ERM)

Bring physical climate intelligence into risk registers, board reporting, and control frameworks, replacing fragmented assessments with systemic, portfolio-wide visibility.

Capital allocation and resilience planning

Prioritise investments, maintenance, and adaptation budgets based on quantified downside and criticality, directing resources where they matter most.

Disclosure and reporting

Generate portfolio-ready evidence aligned with climate disclosure reports to demonstrate governance and resilience with confidence.

Insurance and underwriting

Strengthen pricing, coverage, and renewal decisions with standardised exposure data across large portfolios.

Strategic planning and M&A

Compare regional exposure, acquisition targets, or business units under multiple scenarios to inform growth, consolidation, or divestment strategies.

Used across sectors where portfolios define performance

Mitiga Solutions supports organisations managing large, distributed, or capital-intensive portfolios, where climate exposure, operational continuity, and financial performance are tightly linked.

Financial services

Screen financed or insured assets for concentration risk and portfolio exposure using consistent, comparable metrics.

Infrastructure & transport

Evaluate risk across airports, ports, railways, and highways to guide investment and long-term maintenance planning.

Real estate & construction

Quantify exposure across residential, commercial, and industrial portfolios to protect valuation, liquidity, and insurability.

Logistics & manufacturing

Prevent costly downtime and supply-chain disruption by locating and mitigating regional climate hotspots.

Telecoms & data centres

Safeguard network continuity and uptime by identifying exposure to heat, flood, and wind extremes across distributed sites.

Energy & utilities

Assess exposure across generation plants, grids, and infrastructure to safeguard supply, reliability, and asset value.

Trusted by organisations managing critical, high-value portfolios

Award-winning climate intelligence

Frequently asked questions

Portfolio assessment is the process of evaluating physical climate risks across all assets, regions, or business units within an organisation. It identifies where exposure concentrates, how it evolves under future scenarios, and what it means for performance, value, and disclosure.

It’s used by risk, sustainability, finance, and strategy teams who need to understand systemic climate exposure, not just individual site risk, and report defensible results to boards, regulators, and insurers.

Site-level analysis focuses on one asset. Portfolio assessment takes a top-down view, scanning thousands of assets simultaneously to detect hotspots, clusters, and systemic vulnerabilities that are invisible at the individual site scale.

Yes. You can integrate custom fields like asset value, revenue, or operational criticality to link climate exposure with financial relevance and prioritise high-impact assets.

Every hazard signal is bias-corrected and validated against more than 100,000 weather stations, ensuring results are scientifically defensible and audit-ready.

Portfolio-level insights are available in minutes, with deeper financial or engineering analyses delivered by our experts when needed.

Absolutely. Whether you’re analysing a handful of high-value sites or thousands across continents, Mitiga Solutions applies the same validated methodology and metrics. Insights can be exported, integrated via API, or refreshed as portfolios, assets, or climate conditions change.

Turn climate uncertainty into portfolio advantage

See where risk concentrates, how it evolves, and what it means for your most valuable assets. Work with Mitiga Solutions’ scientists and strategists to bring decision-ready climate foresight into every portfolio and investment decision.