Among the European Sustainability Reporting Standards (ESRS), ESRS E1: Climate Change is one of the most urgent and widely applicable, especially for companies preparing to report under the Corporate Sustainability Reporting Directive (CSRD).

It’s also one of the most complex.

Why? Because nearly every organisation across sectors like real estate, finance, manufacturing, and energy is exposed to climate-related risks and impacts, making climate change a likely material topic under CSRD.

In this context, material means the issue is significant enough to influence a company’s impacts, business model, or stakeholders’ decisions. Therefore, must be included in your sustainability report.

ESRS E1, the climate-focused standard within the ESRS framework, doesn’t just address emissions. It requires companies to assess and disclose:

- Physical climate risks, such as flooding, extreme heat, or wildfires

- Transition risks, including carbon pricing or regulatory penalties

- Mitigation strategies to reduce greenhouse gas emissions

- Adaptation plans to prepare for future climate conditions

Climate change is no longer a distant concern. Under CSRD, and specifically through the requirements of ESRS E1, companies must show how climate affects their business and how they plan to respond.

A clear understanding of climate risk supports long-term resilience and informed decision-making. But without the right tools, reporting under ESRS E1 can feel overwhelming.

That’s why we created this guide: to break down the standard and show how platforms like Disclose can make the process faster, easier, and more reliable.

What is ESRS E1?

ESRS E1 is the Climate Change standard within the European Sustainability Reporting Standards (ESRS). It defines how companies should report on climate-related risks, opportunities, and mitigation strategies as part of CSRD compliance.

It’s one of the 12 topical ESRS standards and arguably the most frequently material across sectors.

What makes ESRS E1 unique is that it covers 4 key areas of climate-related reporting:

- Physical climate risks: How acute events (like floods or wildfires) and chronic climate changes (like rising temperatures or sea levels) could affect company assets, operations, or supply chains

- Transition risks: How the shift to a low-carbon economy may create risks related to policy and legal changes, technology shifts, market dynamics, or reputation

- Climate mitigation: What the company is doing to reduce greenhouse gas emissions (Scope 1, 2, and 3) in line with climate goals

- Climate adaptation: How the company is responding to those risks through adaptation plans, resilience measures, and preparedness strategies.

Each of these categories requires specific disclosures often at a granular, asset-level scale. Companies must not only identify risks but also disclose strategies, targets, metrics, and governance.

Key takeaway: ESRS E1 isn’t just about showing that you’re tracking emissions. It’s about demonstrating that you understand your risk exposure and have credible, forward-looking strategies in place.

What you need to report under ESRS E1

ESRS E1 is structured around 4 core reporting areas. Below is a breakdown of what each area includes, plus examples to help clarify how this plays out in practice.

1. Physical climate risks

Companies must identify and disclose how physical climate hazards could disrupt operations, damage assets, or impact financial performance.

This includes:

- Acute risks like flooding, storms (blizzards), wildfires, and heatwaves

- Chronic risks such as long-term temperature rise (heat stress) or sea level rise

For example, a commercial property group may need to disclose flood risk exposure for coastal assets, including financial impacts projected across short-, medium-, and long-term time horizons as required by ESRS E1.

A company managing older buildings in urban heat islands may need to evaluate whether its cooling systems are sufficient to maintain safe conditions during increasingly frequent heatwaves.

Tip: While return periods (e.g. 20, 100, 500 years) aren’t required under CSRD, they can be helpful for internal risk planning and aligning with insurance or investment strategies.

2. Transition risks

Transition risks stem from changes in policy, regulation, technology, and market preferences as the global economy shifts toward net zero. Under ESRS E1, companies must disclose how these developments could affect their business model, operations, revenue, or asset values.

This includes:

- Policy and legal risks: e.g. carbon pricing, emissions caps, energy performance regulations, or mandatory retrofitting

- Market risks: e.g. reduced demand for inefficient or high-emission assets, or shifts in capital flows away from high-carbon sectors

- Reputational risks: e.g. investor or customer backlash, accusations of greenwashing, or poor ESG ratings

- Technology risks: e.g. pressure to upgrade or replace systems to comply with new performance standards or keep pace with low-carbon innovation

Example of transition risk in real estate:

A property developer continuing to build or operate energy-inefficient buildings may face multiple transition risks:

- Policy risk if new regulations (like updated Energy Performance Certificates or building codes) render assets non-compliant

- Market risk as tenants and buyers favour energy-efficient properties to reduce operational costs and meet their own ESG goals

- Reputational risk as investors or lenders avoid projects that contribute to high operational or embodied emissions

- Technology risk if alternative materials or design approaches become the industry standard, leaving outdated practices behind

Over time, these factors can result in stranded assets, buildings that lose value or require expensive retrofits due to poor environmental performance.

Key takeaway: Transition risks aren’t limited to regulation. They also include shifting market dynamics, financing trends, brand perception, and stakeholder expectations, all of which can materially affect long-term asset value.

3. Climate mitigation

This part of ESRS E1 focuses on what the company is doing to reduce its climate impact. It includes:

- GHG emissions disclosure across Scope 1, 2, and 3

- Net zero targets and decarbonisation plans

- Use of renewable energy or low-carbon technologies

Tip: Many companies struggle with Scope 3 (indirect emissions across your value chain). Focus first on mapping your value chain and using spend-based estimates before moving to more granular data.

4. Climate adaptation

Adaptation is about preparing for the physical climate risks that can’t be avoided. Under ESRS E1, companies must disclose:

- Vulnerabilities identified through physical climate risk assessments (e.g. locations exposed to flooding or heat stress)

- Strategies to reduce exposure and increase resilience at asset or operational level

- Investment plans to implement adaptation measures (e.g. upgrading infrastructure, relocating critical assets)

Key takeaway: Adaptation is as important as mitigation. Reporting both shows you’re prepared for both sides of the risk equation.

Example of effective ESRS E1 reporting

In its 2024 report, Ørsted provides a strong climate risk disclosure aligned with ESRS E1, including:

- Asset-level physical climate risk assessments across short-, medium-, and long-term horizons

- Physical risk modelling under worst-case scenarios (SSP5-8.5), including heatwaves and changing wind patterns

- Quantified transition risks, such as shifting regulations and policy support

- Integration of climate risks into enterprise risk management and EU Taxonomy alignment

While Ørsted has the resources of a global energy leader, smaller teams can now meet similar standards more efficiently, faster and with fewer internal bottlenecks, using tools like Disclose.

This tool offers ready-made outputs structured to match ESRS E1 requirements, streamlining preparation and reducing the likelihood of errors or omissions.

How to comply with ESRS E1: A checklist

Meeting the requirements of ESRS E1 takes more than reporting, it demands a coordinated, cross-functional effort.

This checklist walks through the 5 essential steps companies should take to comply with climate disclosure under CSRD.

1. Start with a double materiality assessment

Before diving into disclosure, determine whether climate change is material to your business in terms of:

- Financial materiality: How climate risks impact your business

- Impact materiality: How your business contributes to climate change

Tip: For most industries, climate is universally material, so expect to report under ESRS E1 unless justified otherwise.

2. Centralise ESG and asset-level data

Data gaps are the biggest blocker to ESRS S1 compliance. You need granular asset-level insights on emissions, asset locations, climate risks, and mitigation efforts.

To get started:

- Map ESG data across departments (finance, ops, sustainability)

- Tag asset-level data to regions, climate zones, and risk types

- Identify gaps early, especially in Scope 3 and value chain exposure

Platforms like Disclose integrate physical climate risk data directly with your asset inventory.

This includes modelling risk across three emissions scenarios and time horizons (short-, medium-, long-term), giving teams the accurate, forward-looking data they need to assess exposure and plan mitigation strategies.

3. Run a physical climate risk assessment

Use climate models and scenario analysis to quantify:

- Exposure: Which assets are vulnerable to heat, floods, wind, wildfire, etc.

- Severity: Assess how risk levels change under different emissions scenarios and across short-, medium-, and long-term time horizons

- Financial materiality: Translate hazard exposure into financial risk (e.g. using metrics like CVaR)

A physical climate risk assessment isn’t just for real estate or infrastructure. Financial institutions and service businesses also need to understand how location-based risks could affect assets, operations, or clients.

Tip: Disclose automates physical risk assessments by producing Excel outputs aligned to ESRS E1.

4. Integrate climate into governance and strategy

ESRS E1 isn’t just about data, it’s about how your company governs and acts on climate risk. You’ll need to report on:

- Board oversight and executive responsibilities

- Risk integration into business strategy

- Scenario planning, transition plans, and decarbonisation roadmaps

Key takeaway: Climate risk should be reflected in your risk register, strategic planning, and board-level decisions.

5. Engage assurance providers early

CSRD requires limited assurance (and eventually reasonable assurance) on your disclosures, similar to financial audits.

- Document your assumptions and methodologies

- Use structured outputs that are easy to verify

- Begin discussions with your auditors before your first reporting cycle

Tip: Disclose standardised outputs help create auditable reports, reducing the burden during external reviews.

Need a step-by-step guide to get started? Download our practical resource: CSRD compliance checklist to clarify your ESRS E1 obligations and identify next steps.

How Disclose supports ESRS E1 compliance

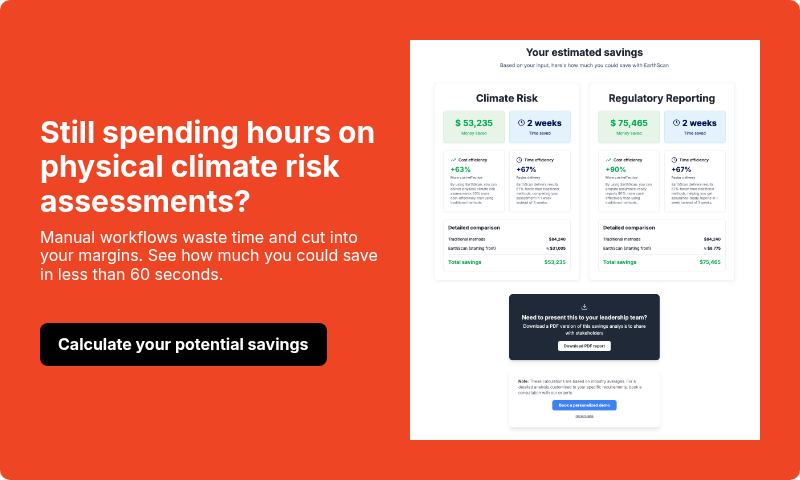

Reporting under ESRS E1 is demanding, especially when it comes to understanding physical climate risk. Most companies don’t have the in-house tools or data to model climate hazards, assess materiality across different scenarios and time horizons, and generate disclosure-ready reports.

That’s where Disclose comes in.

Disclose helps organisations meet CSRD requirements under ESRS E1 by providing asset-level, science-based insights on physical climate risk, from floods and wildfires to heat stress and coastal inundation. It models how each hazard affects each asset over short-, medium-, and long-term horizons, across multiple emissions scenarios.

It translates complex modelling outputs into clear, actionable reports tailored to the ESRS E1 standard, helping you meet climate disclosure expectations with speed and confidence.

What you get from Disclose:

- Coverage of 10 key physical climate hazards, including both chronic (e.g. heat stress, sea level rise) and acute (e.g. floods, wildfires, storms) risks

- Financial risk outputs like Climate Value at Risk (CVaR) and materiality indicators

- Pre-built Excel report mapped to ESRS E1 disclosure fields

- Pre-filled templates aligned with ESRS E1, ready for internal and external reporting

- Flagged assets and hazards based on severity and modelled risk levels

- Portfolio-wide risk summaries and detailed asset-level breakdowns for decision-making

- Support for assurance readiness and investor engagement

Key takeaway: If you’re preparing to report under ESRS E1, Disclose gives you the physical risk insights, format, and structure you need without having to build it all yourself.

Next steps for physical climate risk disclosure

ESRS E1 is one of the most widely applicable and technically demanding requirements under CSRD. It asks tough, but necessary, questions: Where are your physical climate risks? What’s their financial impact? And what are you doing to manage them?

The good news? You don’t have to start from scratch.

With tools like Disclose, sustainability teams, consultants, and ESG leads can move from manual assessments and scattered data to automated, audit-ready reporting aligned with ESRS E1.

If you’re preparing for your first CSRD report or helping clients do the same, now is the time to get your physical risk reporting in order.

To explore how EarthScan Disclose can support your reporting process, book a guided demo or start a no-obligation trial.